Managing small businesses can be a really tricky experience for young entrepreneurs. Payroll is among the different necessities you will have to deal with during those times of management. Paying salaries, keeping accurate records, paying payroll taxes but also maintaining a good communication within your employee, all of those concepts will be challenges to face all the time. Many small business owners are finding that they can simplify the process by using an outsourced payroll provider to manage the entire process and by doing so, save time and have the job done efficiently.

What exactly is outsourcing a payroll?

Processing payroll internally remains a delicate and time consuming process especially for newly created small businesses. Leaving payroll to experts to outsource it has proved to save a lot of time so that you can devote to other important parts of your business. Whether it is your time, staff time, or a combination, chances are the hours could be better spent winning more business, improving customer service, fine-tuning business operations or launching a new product line.

Among the areas where outsourcing will prove to save time are:

1. Processing payroll

2. Cutting and distributing paychecks

3. Calculating and paying withholding and employment taxes

4. Handling employee payroll inquiries

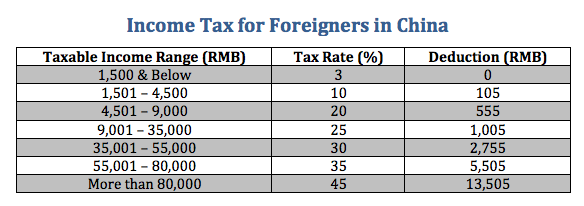

Those services are even best outsourced in a country like China where the culture, business methods and currency are different and delicate to handle.

Not only failing to deal with payroll on time can be prejudicial for your business, but also committing mistakes. Calculating federal, state, local employment taxes and filing payroll-related tax paperwork can be more than just a hassle. If done incorrectly, your small business may face penalties and even interest on money owed since the mistake was made. In fact, it is estimated that one in three small businesses receive a tax penalty costing over $800 each year.

As a fact, outsourcing the payroll can minimize such risks, especially because:

1. An outsourced payroll provider calculates payroll taxes, based on its expertise and close tracking of regulation changes

2. Monthly or quarterly employment tax reports are managed by the payroll service, ensuring they are submitted correctly and on time

3. Payroll providers may assume penalties that come as a result of incorrect tax calculations

Many business owners underestimate the cost of processing payroll internally by failing to take into account all the hours spent and resources allocated to pay employees and to maintain consistent payroll paperwork. A thorough cost assessment usually proves that a small business saves money by outsourcing the processing, tracking and filing of payroll documents.

To assess your own internal payroll costs, consider:

1. How much the time spent is actually worth: consider the cost of your time and the time of anyone who processes or is implicated in payroll. Often, many people in a small company are involved in the various parts of payroll processing.

2. What savings would outsourcing provide: since an outside provider can handle all the responsibilities involved in managing payroll and answering employee questions, a small business can often eliminate or reallocate an internal payroll resource.